Kraken vs Binance are both well-known exchanges. Kraken is the exchange that prioritizes security and Regulation, while Binance is the global leader that offers a user-friendly platform with a vast selection of features. They both provide platforms for buying, selling, and trading digital assets, each with its own set of features.

This detailed comparison explores their security, regulations, trading features, fees, and special features to assist you in choosing the right exchange for your cryptocurrency endeavors. So, which is better, Binance or Kraken?

Kraken vs Binance Overview

Below is a short overview of each point we will discuss in this article.

| Kraken | Binance | |

| Fees | ・ Maker-taker fee schedule plus non-instant buy volume incentives over 30-day activities. ・ 0.00% to 0.25% per trade for makers, 0.10% to 0.40% for takers. ・ Margin trading fee 0.02% per 4 hours on supported crypto pairs. ・ OTC service fee is quote-based on order volume above $100k. | ・ Maker-taker fee schedule with VIP-based trading benefits. ・ 0.009% to 0.075% based on VIP level and trade volume on Spot, Margin, and Trading Bots. 25% off fees on BNB charges. ・ 2% on a Euro Bank Visa, 1.5EUR on a Bank (SEPA) transfer, or $15 per U.S. wire transfer. |

| Security | 2FA (Google and Yubikey Authenticator), email confirmations, API key regulation, SSL, and data encryption. | 2FA authentication, including hardware, app-based, SMS and email methods, RSA Api key pairing, |

| Supported Crypto Assets | 240+ | 350+ |

| Applications | Android and iOS | Android, iOS, Windows, Linux, and macOS |

| Supported Fiat Trading | USD/EUR + more | USD/EUR + more |

| Supported Transactions | Buy, sell, send, receive, staking, exchange, margin trading, limit order, market order, stop-loss limit order, stop-loss market order, futures trading, take-profit market order, and more. | Asset conversion, staking, limit order, market order, stop-limit order, trailing stop order, post-only order, peer-to-peer trading, margin trading, one-cancels-the-other order, and more. |

Pros and Cons List

Below, we will overview both exchanges’ general pros and cons so you can get a first impression.

Kraken

| Pros | Cons |

| ✅ Provides good customer service options. ✅ Fee is relatively low for BTC withdrawal. ✅ Offers comprehensive and sophisticated trading features like margin trading. ✅ High liquidity exchange on tradable assets. ✅ Supports over 240 cryptocurrencies. ✅ 24/7 customer support. ✅ A beginner-friendly and easy-to-navigate platform. ✅ Extensive educational materials are available. ✅ A wide range of crypto coins are available for trade ✅Strong security measures for platform and account safety | ❌ Not available to all U.S. residents. ❌ Accepts only a selected few fiat currencies. ❌ The main Kraken platform charges higher fees for users without a pro account. ❌ There have been reports of hacks by some users in the past. |

Binance

| Pros | Cons |

| ✅ Supports a wide variety of crypto coins. ✅ Offers one of the lowest trading fees in the market. ✅ High liquidity on crypto assets listed on the exchange. ✅ Provides advanced trading features and tools for experienced traders. ✅ Provides an easy-to-navigate trading option for low-level crypto traders. ✅ Remains one of the exchanges with the highest number of users worldwide. ✅ Allows users to buy cryptocurrencies with debit/credit cards. ✅ Places strong emphasis on account security. ✅ 24/7 customer support. ✅ Provides a wide range of educational materials to onboard new users. | ❌ There are concerns over regulatory and transparency compliance, as highlighted by recent SEC comments leading to the stepping down of CEO Changpeng Zhao. ❌ Not available for customers in Texas, New York, Hawaii, and Vermont. |

Kraken Exchange vs Binance: Security and Regulations

Security and Regulation are crucial aspects when choosing a cryptocurrency exchange.

Here’s a detailed comparison of Kraken and Binance in these areas:

Kraken and Binance have similar and contrasting approaches to security measures and regulations.

A common denominator is that both exchanges require user Identity Verification, known as Know-Your-Customer (KYC). Identity verification is a mandatory requirement on both platforms in order to adhere to regulatory and compliance commitments.

It should be noted that Kraken offers different levels of user verification depending on account type and country of residence. In some cases, Kraken can withhold funds.

According to Kraken, “Our funding providers may, at their own discretion, deny funding to certain geographical locations. Some regions are not yet able to use debit or credit cards “.

Similarly, Binance implements a stringent and comprehensive KYC process for its users. On March 20, 2024, it announced an enhanced compliance standard, requesting that all sub-accounts get verified. Users are given until May 20, 2024, to get verified or face account restrictions.

In terms of security, both platforms are keen on providing a strong security stance and transparency measures.

Kraken takes security very seriously, offering superior coin storage security. Since its establishment in 2013, Kraken hasn’t experienced any major hacks, even though some individuals on online forums like Reddit have complained about personal account hacks.

The exchange maintains 95% of crypto deposits in geographically distributed offline cold storage. They also keep a full reserve of all crypto assets, allowing users to withdraw their funds anytime. All user data are also encrypted.

Unlike Kraken, Binance had once suffered a heavy security breach. In 2019, over $40 million worth of Bitcoin was stolen from the exchange.

Also, in 2023, the US Justice Department probed Binance for refusal to comply with U.S. law on money laundering, unlicensed money transfers, and other sanctions. This led to the stepping down of the CEO, Changpeng Zhao.

Verdict:

Although Binance offers 2FA authentication, data encryption, and other necessary security measures, Kraken stands out with its overall robust security architecture, commitment to transparency, and safety of customers’ funds.

Supported Currencies

Below is a detailed comparison of supported currencies on Kraken and Binance:

Fiat Currencies

| Kraken (8 options) | Binance (a lot, number constantly growing) |

| USD (U.S. Dollar) EUR (Euro) GBP (British Pound) CAD (Canadian Dollar) JPY (Japanese Yen) CHF (Swiss Franc) AUD (Australian Dollar) AED (Emirati Dirham) (limited availability) | USD (U.S. Dollar) EUR (Euro) GBP (British Pound) AUD (Australian Dollar) BRL (Brazilian Real) BUSD (Binance USD – a stablecoin pegged to USD) USDT (Tether – another USD-pegged stablecoin) And many more (depending on your location) |

Cryptocurrencies

| Kraken (Over 240 cryptocurrencies, including major ones) | Binance (Offers a significantly wider selection of cryptocurrencies, exceeding 500 coins) |

| Bitcoin (BTC) Ethereum (ETH) Cardano (ADA) Dogecoin (DOGE) Litecoin (LTC) Polkadot (DOT) Many more altcoins and stablecoin | Bitcoin (BTC) Ethereum (ETH) Cardano (ADA) Dogecoin (DOGE) Litecoin (LTC) Polkadot (DOT) A vast selection of altcoins with varying market caps Many new and emerging cryptocurrencies |

These cryptocurrencies are often usable on sports betting with crypto sites.

Fiat Deposits

Here is a breakdown of fiat deposits on Kraken vs. Binance:

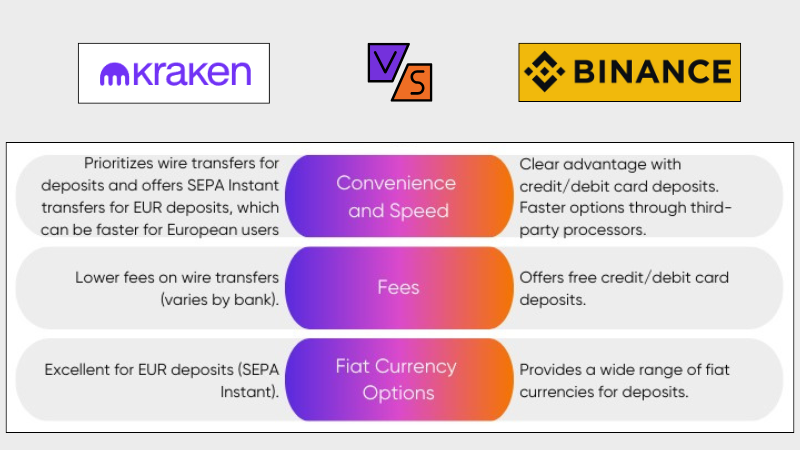

Both exchanges support fiat deposit options on credit/debit cards with Visa and MasterCards, but with Binance offering wider options.

On Kraken, the deposit limit depends on a user’s verification level. Limits are displayed and calculated in USD. The processing fee is also displayed and varied according to the method of payment selected.

On the other hand, Binance supports 29 different fiat deposits with cheaper fees between 0% and 2.2%, depending on the transaction method. Bank transfers are generally fee-free, but they charge 1.5 EUR on SEPA, 1 EUR on SEPA Instant Transfer, and 1 EUR on PayMonade.

Kraken currently supports only six fiat currencies, but they include some of the world’s most widely used: U.S. Dollars (USD), Euros (EUR), British Pounds (GBP), Canadian Dollars (CAD), Swiss Francs (CHF), and Australian Dollars (AUD).

The implication is that customers from countries whose currencies are not on the list will have to first convert to the supported currencies to make a trading pair. Obviously, this will generate additional fees for those users.

Unlike Kraken, Binance supports a wider range of fiat currencies, totaling twelve. These include Australian Dollars (AUD), U.S. Dollars (USD), Euros (EUR), British Pounds (GBP), Canadian Dollars (CAD), Swiss Francs (CHF), Hong Kong Dollars (HKD), Kazakhstani Tenge (KZT), Norwegian Krone (NOK), Peruvian Sol (PEN), Russian Rouble (RUB), Turkish Lira (TRY), Ukrainian Hryvnia (UAH), and Ugandan Shilling (UGX).

Minimum Deposit

Both Kraken and Binance generally have no minimum deposit requirement. However, minimums may apply for specific deposit methods depending on your location and chosen provider.

Processing Times

Kraken

- Wire Transfer: Can take several business days to reflect in your account.

- ACH Deposit (USD only): Typically faster than wire transfers, but can still take 1-3 business days.

- SEPA Instant Deposits (EUR only): Fastest option with near-instant credit to your account.

Binance

- Wire Transfer: Similar to Kraken, can take several business days.

- Credit/Debit Card: Fastest option, with funds typically credited instantly.

- Third-Party Payment Processors: Processing times vary depending on the provider.

- P2P Trading: Depends on finding a suitable counterparty and completing the trade, potentially taking longer than other methods.

Kraken vs Binance Trading Fees

Below, you can find all the information on the trading fees.

Fee Structure

Kraken uses a maker-taker fee structure. This means:

- Makers (users adding liquidity by placing limit orders that don’t immediately get filled) receive discounts on fees.

- Takers (users removing liquidity by placing market orders that get filled immediately) pay a higher fee.

- Fees are tiered based on your 30-day trading volume. Lower volume means higher fees.

- Kraken also offers a discount for using their native token, XMR.

Binance employs a tiered maker-taker fee structure as well, but with some key differences:

- Fees are generally lower than Kraken’s, especially for high-volume traders.

- Binance offers a VIP program with further fee discounts based on your holding of their native token, our reviewed BNB. Holding more BNB unlocks progressively lower fees.

Fee Rates

Kraken: Maker fees start at 0.16% and decrease with higher volume. Taker fees start at 0.26% and can also be reduced with volume. Specific rates depend on your trading volume tier. There’s an additional fee (typically 0.5%) for using their Instant Buy/Sell option.

Binance: Maker fees begin at 0.1000% for non-VIP users and can decrease to 0.0200% for the highest VIP tiers. Taker fees start at 0.1000% for non-VIPs and reach as low as 0.0400% for top VIPs. Users who pay fees with BNB get an additional discount (typically 25%).

Here is a table summarizing the main aspects:

| Feature | Kraken | Binance |

| Fee Structure | Maker-taker | Maker-taker |

| Base Maker Fee | 0.16% | 0.1000% |

| Base Taker Fee | 0.26% | 0.1000% |

| Fee Discounts | Volume tiers, XMR token | Volume tiers, BNB VIP program, BNB payments |

| Generally Lower Fees | No | Yes (especially for high volume) |

Choose Kraken if:

- You’re a maker who adds liquidity through limit orders.

- You trade large volumes and can benefit from Kraken’s volume-based discounts (potentially lower fees than Binance for high volume).

- You prioritize simplicity and prefer a straightforward maker-taker structure without a complex VIP system.

Choose Binance if:

- You’re a taker who relies on market orders.

- You trade high volumes and want to take advantage of Binance’s lower base fees and potential for even deeper discounts through its VIP program and BNB payments.

- You’re comfortable with a more intricate fee structure with VIP tiers and additional discounts.

Margin Trading

Margin trading allows you to amplify your potential returns (and losses) in the cryptocurrency market by borrowing funds from the exchange.

Here’s a breakdown of margin trading on Kraken and Binance:

Supported Assets

Kraken: Offers margin trading for a limited selection of cryptocurrencies compared to Binance. Popular choices on Kraken include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and some margin-enabled stablecoins

Binance: Provides margin trading for a much wider range of cryptocurrencies, including most major coins and a significant number of altcoins.

Maximum Leverage

- Kraken: Provides a conservative maximum leverage ratio, typically 2x to 5x, depending on the asset. This means you can borrow up to 5 times your initial margin to increase your buying power.

- Binance: Generally offers higher maximum leverage ratios, reaching up to 10x or even 20x for some assets. This allows for more aggressive trading strategies but carries significantly higher risk.

Margin Rates

Kraken: Charges competitive margin interest rates, which vary depending on the borrowed asset and market conditions. Rates can be dynamic and change frequently.

Binance: Employs a similar structure with competitive margin rates that fluctuate based on the asset and market. They also offer tiered margin interest rates, where users with higher borrowing amounts may receive slightly lower rates.

Margin Features

Kraken: Offers a relatively basic margin trading experience. You can open long positions (buying on margin) and short positions (borrowing to sell an asset you don’t own), but it lacks some advanced features like isolated margin or cross margin.

Binance: Provides a more feature-rich margin trading platform. It supports long and short positions, isolated margin (limiting risk to a specific position), cross margin (using your entire margin balance for all positions), and advanced order types like stop-loss and take-profit orders to manage risk.

Margin Calls and Liquidations

Both Kraken and Binance have similar mechanisms for margin calls and liquidations.

If the value of your collateral (your initial margin deposit + unrealized profit/loss) falls below a certain threshold (maintenance margin requirement), you will receive a margin call.

If you don’t add more funds to meet the requirement, the exchange will forcefully liquidate your position to minimize its risk.

✔️ Choose Kraken for margin trading if you’re a beginner or prefer lower risk with a simpler interface and limited crypto options.

✔️ Choose Binance if you’re experienced and comfortable with higher risks.

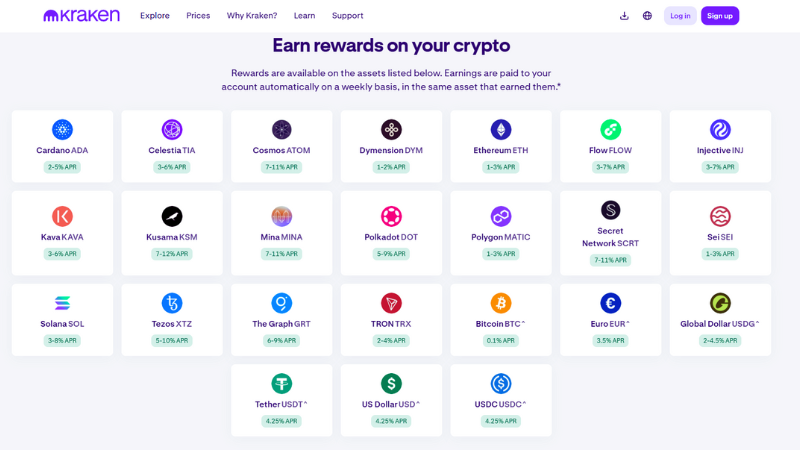

Staking

Staking allows you to earn rewards on your crypto holdings by supporting Proof-of-Stake (PoS) blockchains. Below is a comparison of staking features on Kraken and Binance:

Supported Coins

- Kraken: Offers staking on a limited selection of cryptocurrencies, typically around 14 assets. These include major PoS coins like Tezos (XTZ), Polkadot (DOT), and Cardano (ADA).

- Binance: Provides staking for a significantly wider variety of cryptocurrencies, exceeding 100 coins. They offer staking for most major PoS coins and many lesser-known tokens.

Staking Rewards

- Kraken: Generally offers moderate staking rewards, typically ranging from 4% to 7% annually, depending on the coin. Rewards are paid out in the same coin you stake.

- Binance: Provides a wider range of staking rewards, with some coins offering high yields exceeding 10% or even 100% APY (Annual Percentage Yield). However, these high yields are often for lesser-known coins with higher risk profiles. Established coins on Binance typically offer rewards similar to those of Kraken.

Staking Lockup Periods

- Kraken: Often has flexible staking options with no lockup periods for some coins. This allows you to withdraw your staked assets at any time. However, they also offer fixed-term staking options with potentially higher rewards for locking your coins for a set period.

- Binance: Offers a mix of flexible and locked staking options. Flexible staking typically comes with lower rewards, while locked staking periods can significantly increase your APY.

Minimum Staking Amounts

- Kraken: May have minimum staking requirements for some coins. These requirements can vary depending on the asset.

- Binance: Generally has lower or no minimum staking requirements, making it easier to participate with smaller holdings.

Staking Features

- Kraken: Offers a relatively simple staking experience. You can choose your staking options and view your rewards, but it lacks some advanced features like auto-compounding (automatically reinvesting earned rewards for additional gains).

- Binance: Provides a more feature-rich staking platform. They offer auto-compounding for many coins, flexible and locked staking options, and the ability to earn rewards in additional tokens besides the one you stake.

Consequently, choose Kraken for staking if:

- You prioritize security and a straightforward staking experience.

- You prefer flexible staking options with no lockup periods for some coins.

- You’re comfortable with moderate staking rewards on established coins.

Choose Binance for staking if:

- You want access to a wider variety of coins and the potential for higher staking rewards.

- You don’t mind locking your coins for fixed terms to earn higher APY.

- You’re interested in advanced features like auto-compounding and earning rewards in additional tokens.

User Interface

Here’s a breakdown of the user interfaces (U.I.) on Kraken and Binance to help you decide which might be easier to navigate:

Kraken

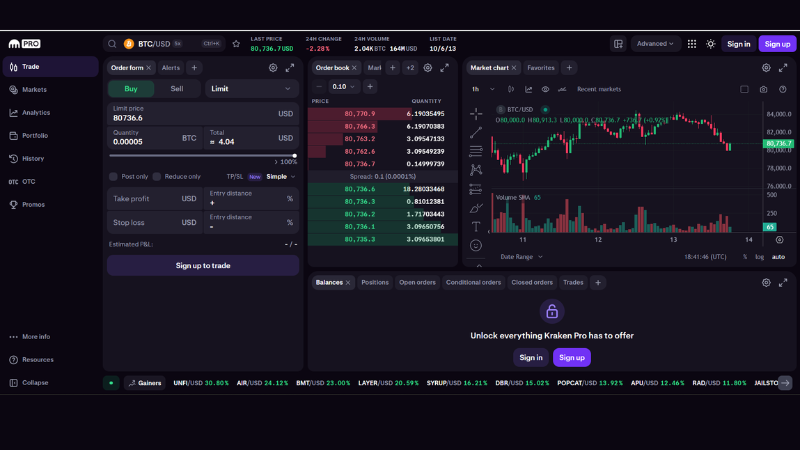

Designed Towards: Experienced traders who value a clear and functional layout.

| Pros | Cons |

| ✅ Clean and uncluttered interface: Easy to find essential features like order books, charts, and trading tools. ✅ Advanced order types: Caters to experienced traders with options for stop-loss, take-profit, and margin orders. ✅ Focus on information: Provides detailed market data and charting tools for in-depth analysis. | ❌ Can be overwhelming for beginners: The abundance of information and features might be intimidating for new users. ❌ Limited educational resources: Kraken offers some basic tutorials but may not be as beginner-friendly as Binance in terms of learning materials. |

Binance

Designed Towards: A wider audience, including both beginners and experienced traders.

| Pros | Cons |

| ✅ User-friendly interface: Intuitive layout with clear menus and navigation. ✅ Simple buying and selling options: Easy to purchase crypto with fiat currency (for some regions) or trade between cryptocurrencies. ✅ Educational resources: Offers a wealth of tutorials, articles, and videos to help beginners learn about crypto and trading. | ❌ Can be cluttered at times: The variety of features and options might seem overwhelming for complete beginners. ❌ Advanced features hidden: Some advanced order types and charting tools may not be as readily accessible as on Kraken. |

The chart below summarizes the key points:

| Feature | Kraken | Binance |

| Target Audience | Experienced Traders | Wider Audience (Beginners & Experienced) |

| Interface Style | Clean & Functional | User-Friendly & Intuitive |

| Order Types | Advanced Options | Basic & Advanced (may be less prominent) |

| Market Data & Charts | Detailed & In-depth | Comprehensive but potentially less advanced |

| Educational Resources | Limited | Extensive Tutorials & Guides |

Choose Kraken if:

- You’re a seasoned trader comfortable with a more technical interface.

- You prioritize advanced order types and in-depth market data analysis.

Choose Binance if:

- You’re a beginner looking for a user-friendly platform to learn the ropes.

- You value easy access to educational resources and a simple buying/selling experience.

Ultimately, the best U.I. depends on your experience level and preferences. If you’re unsure, consider trying both platforms with demo accounts to see which feels more comfortable.

Binance vs Kraken: Unique Features

In many instances, both exchanges offer a variety of similar features but with different approaches and fee structures.

Right-click trading

Kraken recently introduced a new feature called right-click trading. This latest trade functionality provides a smarter and faster way to decide on a trade.

With it, traders can place a limit and stop loss orders directly on the chart of the crypto asset they’re interacting with. This will reduce the risk of mistake-prone trading while encouraging precision, speed, and strategic risk management in asset trading. This feature is only available for Kraken Pro account owners.

Right-click trading feature is not available on Binance. Even at that, Binance provides all the neccesary tools such as Analytics Data Sources & Tools for a more seamless trading experience.

Over-the-Counter (OTC) Trading

Kraken’s personalized OTC trading supports over 150 pairs of assets. It is designed to care for clients who need to execute large orders on their assets. Traders can get instant and single quotes on orders above $100,000 worth of assets.

To get started with Kraken’s OTC trading, users will need to fill out a form. The form requires that you indicate your email and country of residence, as well as details on the amount and the name of the asset you intend to trade. Settlement is within 24 hours.

Similar to Kraken, Binance also offers personalized OTC trading but with a slightly different approach. For instance, while Kraken’s minimum asset value is upwards of $100,000, Binance requires a minimum of $200,000 equivalent assets in the spot wallet to access the OTC chat function.

Binance also offers Algo orders that facilitate large or illiquid trades over a period of time to reduce execution costs and mitigate market impact.

Spot Margin Trading and Futures Funding

Kraken offers a pro trading interface for experienced traders looking to power up their trading strategies with up to 5x leverage on liquid markets.

Depending on the margin pair chosen, the trading fee ranges between 0.01% and 0.02% to open a position. There’s a rollover fee that occurs every 4 hours on open trading. Margin trading is currently available on Kraken with just 53 crypto assets, including popular ones like Bitcoin, Ethereum, Dash, Cardano, an more.

Similar to margin trading, Kraken lets experienced traders expand their trading experience with over 95 perpetual futures using leverage on liquid markets.

Once a user opens a trade by taking long or short positions, he gets to enjoy one of the lowest fees of as low as 0.01%. It should be noted that Kraken’s Futures trading is subject to national restrictions and limitations in the countries listed:

| Afghanistan | Iran | Singapore |

| Australia (and territories) | Iraq | Spain |

| Belarus | Italy | Syria |

| Canada | United States (and territories) | Tajikistan |

| Cuba | Libya | United Kingdom |

| Democratic Republic of Congo | Russia | Ukraine (Crimea, Donetsk & Luhansk regions) |

Binance offers margin trading on over 600 crypto pairs, providing more options than Kraken. Traders can choose between Isolated and Cross-margin, with fees as low as 0.075% (25% off with BNB).

Binance Futures supports 280+ trading pairs with up to 125x leverage on Bitcoin. It allows settlement in stablecoins (USDⓈ-M Futures) or the traded cryptocurrency (COIN-M Futures), offering both quarterly and perpetual contracts. Fees are tier-based, depending on trading volume and BNB holdings.

NFT Marketplace

Kraken NFT marketplace offers users the opportunity to trade their unique digital assets. It features over 250 NFT collections and supports Ethereum, Polygon, and Solana chains. Kraken also allows NFT clients to list their digital assets using any of the supported fiat or crypto options.

NFT trade is supported by over 200 crypto options and 8 different fiat currencies. NFT trading fee structure: Zero percent on deposits. There‘s a 0.01 ETH fee on Ethereum chain withdrawals and 0.02 SOL on Solana chain. Gas fees also apply on all withdrawals based on the chosen network.

On the other hand, Binance boasts a large and active NFT marketplace where users can buy, sell, bid, mint, burn, or stake their non-fungible assets. Binance NFT marketplace features different categories of NFTs ranging from sports, arts, esports, and entertainment. It features 380 different NFT collections.

Unlike Kraken’s NFT marketplace that supports multichain blockchain, Binance only supports NFT trading on its native chain, BNB. Transaction fees on the Binance NFT marketplace vary and are calculated based on various factors, which include market conditions and network status.

Now, it is trendy to buy sports NFTs.

Remember, these are just a few examples. Both Kraken and Binance continue to change and introduce new features.

Choosing the Right Exchange: Kraken or Binance

Selecting the right cryptocurrency exchange can impact your overall trading experience. Here’s a detailed breakdown of key factors to consider when choosing between Kraken and Binance:

Trading Experience

Kraken is a more seasoned crypto exchange that allows users to purchase their crypto assets with their bank cards or bank accounts, even if they’re doing so for the first time.

It is more suitable for advanced traders, offering them the ‘Kraken Pro’ platform with custom layouts so they can have access to a broader range of assets. Kraken also equips traders with all the usual charts and indicators needed to place, monitor, and conclude a trade.

Binance, on the other hand, offers a more simplified trading experience with easy-to-navigate features like instant purchases for those looking to own their first cryptocurrency.

They also have the instant ‘convert ‘function, which makes it easy to swap crypto from one crypto to another without using complex charts or order books. However, advanced traders also have the option to switch to professional mode, where they can use all the usual charts and indicators for their trades.

In short, while Kraken is a more pro-centric exchange, it still allows crypto beginners to buy their own cryptocurrency. However, Binance offers a more beginner-friendly crypto trading experience with advanced trading options for professionals.

Kraken Fees vs Binance

- Kraken: Uses a maker-taker fee structure with discounts for higher trading volume and holding their XMR token. However, their base fees may be slightly higher than Binance, especially for low-volume traders.

- Binance: Generally offers lower trading fees, especially for high-volume traders. They also have a VIP program with even deeper discounts for users who hold their BNB token and pay fees with it.

Supported Currencies and Assets

- Kraken: Supports a good selection of cryptocurrencies (over 240) and fiat currencies (around eight). They excel with EUR deposits (SEPA Instant).

- Binance: Offers a significantly wider variety of cryptocurrencies (over 500) and fiat deposit options (depending on your location). They cater to users who want access to a broader market.

Unique Features

- Kraken: Offers OTC trading for high-volume trades, margin funding for experienced users, and staking rewards boosted by holding XMR. They prioritize security and Regulation.

- Binance: Provides a comprehensive DeFi suite with products beyond staking, margin lending with flexible terms, an NFT marketplace, and advanced trading features like futures contracts.

By carefully evaluating these factors and your own priorities, you can make an informed decision about which exchange – Kraken or Binance – is the right fit for your cryptocurrency trading journey.

Conclusion: Kraken vs. Binance Comparison

Kraken and Binance are both great crypto exchanges, but they suit different types of users. Kraken focuses on security and regulation, making it a solid choice for serious traders, especially in the U.S. Binance, on the other hand, offers lower fees, more cryptocurrencies, and extra features, making it better for those who want variety and flexibility. If you care most about security, go for Kraken; if you want more coins and lower costs, Binance is a better fit.

FAQs About Kraken vs. Binance Exchange Comparison

Which exchange is better, Kraken or Binance?

Kraken is known for strong security and regulatory compliance, while Binance offers lower fees, more cryptocurrencies, and a user-friendly interface. The best choice depends on your priorities.

Does Binance have lower trading fees than Kraken?

✅ Yes, Binance generally has lower trading fees, especially for high-volume traders and those using BNB to pay fees.

Which exchange supports more cryptocurrencies?

Binance supports over 350 cryptocurrencies, while Kraken offers around 240. Binance has a broader selection, including newer altcoins.

Is Kraken safer than Binance?

Kraken has never been hacked and follows strict security and regulatory measures. Binance has had past security breaches but also implements strong security features.

Is Kraken or Binance a CEX or DEX?

Both Kraken and Binance are centralized exchanges (CEXs) that offer high liquidity, advanced trading features, and regulatory compliance. If you’re interested in learning more about the differences between CEX vs DEX, check out our detailed guide.